In an article for Taxation magazine, we examine the impact of the Liechtenstein Disclosure Facility’s closure.

KEY POINTS

- The final six months of the Liechtenstein disclosure facility and Crown Dependency disclosure facilities.

- Three disclosure facilities have collected more than £1.5bn of UK tax.

- The Liechtenstein disclosure facility is being restricted.

- Introduction of final worldwide disclosure facility from 1 January 2016.

- Will the new facility be better than the LDF?

- The interaction of Crown Dependency facility and code or practice 9.

Since 2006, HMRC have offered disclosure facilities to encourage individuals to declare unpaid taxes connected with overseas bank accounts or structures.

These include the offshore disclosure facility (ODF), the new disclosure opportunity (NDO) and, currently, the Liechtenstein disclosure facility (LDF).

These facilities have enabled HMRC to collect sizeable sums of monies at a time when staff cuts were having a dramatic impact on the resources that the department could otherwise devote to investigations.

For example, together the ODF and NDO collected more than £650m and between its introduction in 2009 and March 2015 the total yield generated by the LDF has been more than £1bn.

Times have changed since the start of the LDF, and this article considers the impact of its early closure and the measures that will replace it from 1 January 2016.

Liechtenstein disclosure facility

In September 2009, HMRC announced the introduction of what was primarily an offshore tax disclosure facility called the Liechtenstein disclosure facility (LDF).

The principal concepts of the two previous facilities were taken on board, together with certain other benefits to entice individuals to come forward.

Initially, the disclosure facility was to close on 31 March 2015, but this was later extended to 5 April 2016. However, the end date has now been revised again to 31 December 2015.

The LDF results from an agreement signed between the UK and Liechtenstein governments which enable any persons with unreported liabilities connected with assets held overseas to settle with HMRC on favourable terms.

These include:

- no liability for any period before 6 April 1999;

- a fixed 10% penalty for periods from 6 April 1999 to 5 April 2009:

- the ability to choose a single composite rate rather than calculate actual liabilities;

- a single point of contact for disclosures; and

- immunity from prosecution for the tax offence.

While the facility was designed primarily to disclose unpaid taxes relating to overseas accounts, it was possible to disclose even wholly domestic matters and still retain the favourable terms.

Further, even when an enquiry had been started it was possible to “flip” the enquiry into the facility as long as it had not been undertaken under HMRC’s Code of Practice 9 (suspected tax fraud).

Some aspects of the LDF were, frankly, too good to last. Thus, in August 2014, HMRC announced that, to ensure the spirit of the LDF was not being abused, the scope of the facility would be reduced in some cases.

These restricted cases fall into three broad categories.

- Cases where the relevant person enters the LDF to settle liabilities of which HMRC is already aware.

- Cases where the particular issue disclosed has already been subject to an HMRC intervention (broadly, enquiry) that began more than three months before the date of application.

- Cases where there is no substantial connection between the liabilities disclosed and any offshore asset held by the relevant person on 1 September 2009.

In such cases, the first three LDF benefits listed above are not available, namely:

- No liability for any period before 6 April 1999.

- A fixed 10% penalty for periods from 6 April 1999 to 5 April 2009.

- The ability to choose a single composite rate rather than calculate actual liabilities.

The last two LDF benefits listed above, namely a single point of contact for disclosures and immunity from prosecution, remain available.

This leaves immunity from prosecution as the key LDF benefit in such cases. In some circumstances, such as when the taxpayer is within one of the groups particularly at risk of prosecution for tax fraud, this is extremely valuable.

Mechanics of the facility

To take advantage of the facility it is not necessary to have held a bank account or other investments in Liechtenstein previously. Where this is the case “relevant property” must be established in the principality.

The most straightforward way of doing this is by opening a bank account with a Liechtenstein financial institution. Ordinarily, a bank account can be opened within 24 hours of completing the relevant paperwork.

However, since 1 December 2011, the Liechtenstein financial institution has to issue a confirmation of relevance statement. This confirms that the individual:

- has a substantial portion of the assets affected by the disclosure invested or managed in Liechtenstein or has personal contact with the financial intermediary;

- the client relationship is long term; and

- the services provided are not merely of secondary importance.

HMRC will require sight of the confirmation of relevance before issuing an LDF registration certificate.

Once an individual has been accepted into the facility, a registration certificate together with a registration pack will be issued. The registration certificate has to be submitted to the Liechtenstein financial institution within 30 days of registration.

The LDF provides for two methods to calculate the tax liabilities.

The first is on a strict actual basis. The time limit for disclosing under this method and settling the outstanding tax is 10 months from the date of the registration certificate.

The second method is known as the composite rate option (CRO). This simply seeks to tax all UK income and gains at a single rate of 40%; however, this method (if applicable) requires an election to be made and is irrevocable.

The time limit for disclosing and paying under this method is seven months from the date of the registration certificate. In addition, and where appropriate, for years after 2008/09 individuals can elect for single charge rate (SCR), which is similar to the CRO option, but taxes income and gains at a single rate of 50%.

Each disclosure needs to be considered carefully to ascertain whether to calculate liabilities under the actual rate or CRO/SCR. This is because, under CRO or SCR, it is not possible to deduct costs or reliefs when calculating income or gains.

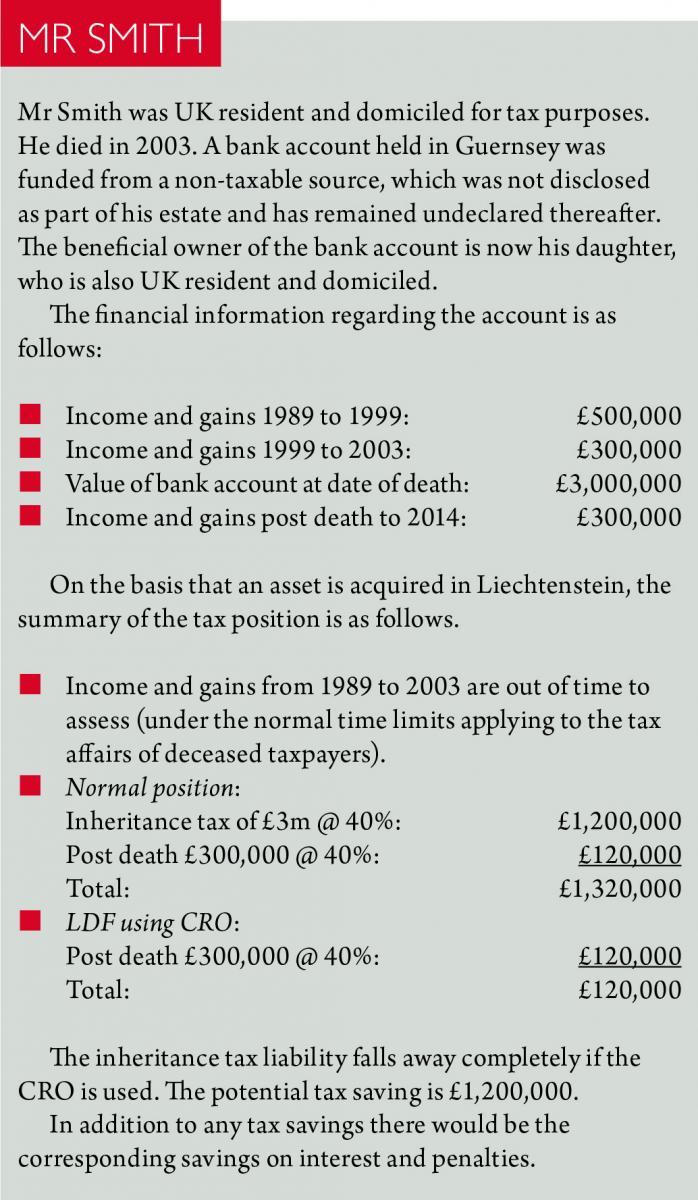

However, this methodology can bring a significant financial advantage where inheritance tax is in point, because it has the ability to “wash out” all inheritance tax charges on the basis that CRO or SCR calculation is in lieu of all taxes (see the LDF detailed guidance at 7.3).

This is an extremely beneficial advantage of using the LDF and one that is not always fully appreciated.

This is illustrated by the example of Mr Smith.

The amounts of tax, interest and penalties are entered on standard forms, with a narrative of the disclosure setting out the nature and extent of the issue in a covering letter or, in more complex cases, a formal disclosure report.

A letter of acknowledgement will be sent by HMRC within 30 days of receiving the disclosure.

Payment of all liabilities must be made at the same time as the disclosure is submitted.

HMRC will issue a disclosure certificate which will have to be submitted to the Liechtenstein financial institution within

30 days of receipt.

Although the LDF has been the most prominent disclosure facility of recent years, it should not be overlooked that HMRC also launched disclosure facilities for the Crown Dependencies of the Isle of Man, Jersey and Guernsey.

Although these did not offer the same level of benefits – there was no immunity from prosecution for the tax offence nor was it possible to elect for the CRO/SCR – these facilities were thought to offer individuals an opportunity to come forward if the unpaid taxes in the said jurisdictions were of a level that it was not appropriate to disclose under the LDF.

However, like the LDF, these facilities will close on 31 December 2015.

Son of LDF

From 1 January 2016, individuals who wish to come forward to disclose unpaid taxes connected with an overseas bank account or structure will not be able to avail themselves of either the LDF or the Crown Dependency disclosure facilities.

However, in the latest budget, HMRC announced that there would be one final disclosure facility to run between 2016 and 2017.

This coincides with the provision of tax information under the inter-governmental agreements (IGAs) in 2016 and the common reporting standard from 2017.

At present, only limited details have been released about this new facility.

However it is highly likely that from a practical perspective it will use the format of the LDF in terms of timescale and reporting the disclosure to HMRC.

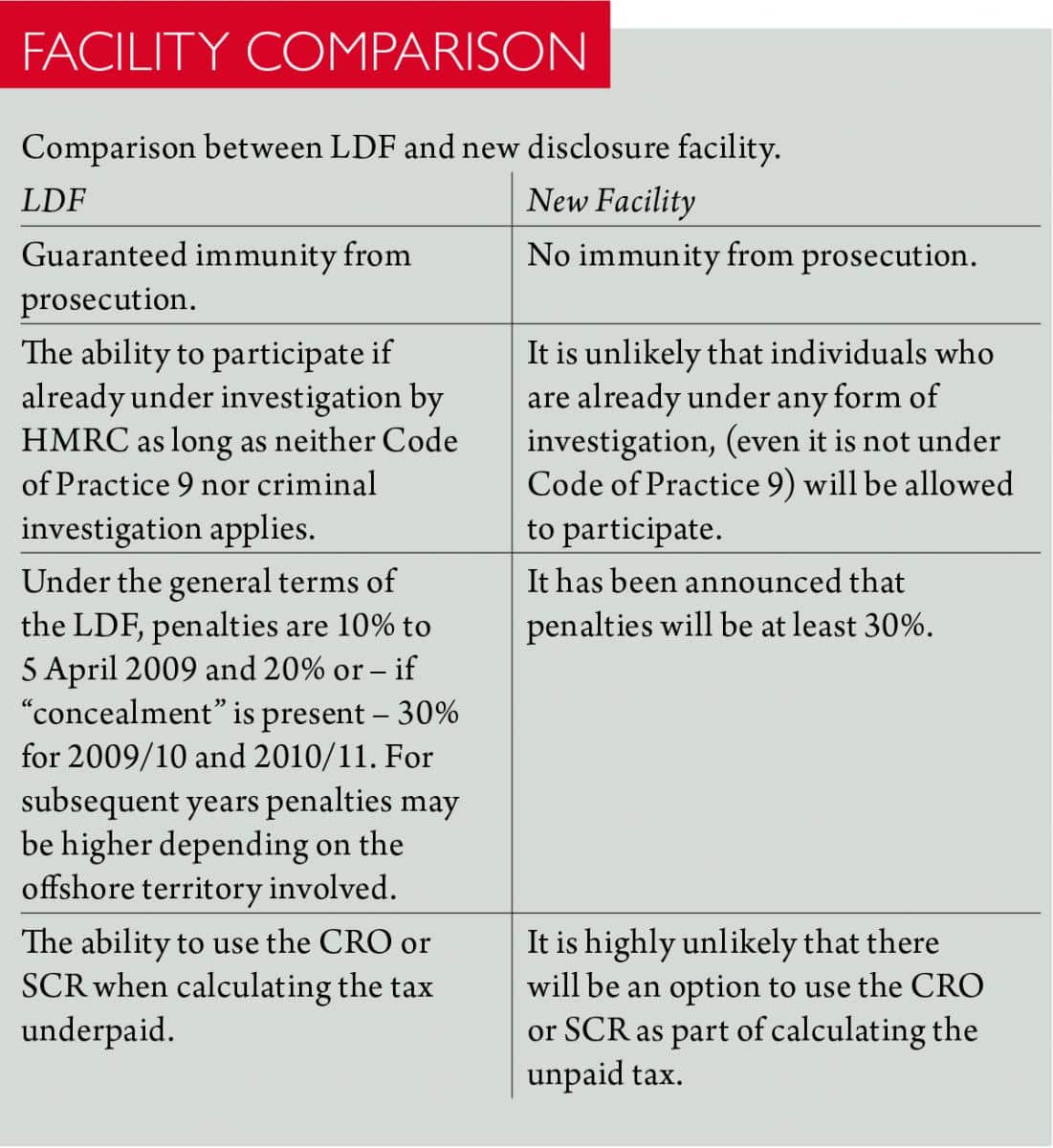

The one aspect that is clearly known is that its terms will certainly not be as advantageous in several respects as those offered under the LDF.

This is illustrated by Facility Comparison.

Based on the above comparisons, the new facility (whatever it may be called) is not going to be as beneficial as the LDF.

Advisers have already argued that the removal of the immunity from prosecution and higher penalties will have a negative impact on individuals coming forward to disclose.

However, it is believed that the removal of these incentives is a toughening up of HMRC’s stance in tackling offshore evasion and therefore is seen as the definitive final disclosure facility.

More investigations on the way?

With the more aggressive stance HMRC are taking in relation to offshore matters, it is likely that there will be an increase in targeted investigations from 1 January 2016.

There is a high probability that code of practice 9 (COP9) and the contractual disclosure facility (CDF) will be used in increasing numbers to pursue individuals who have not taken advantage of previously available disclosure facilities.

It should not be taken as read that the CDF process will remain as it is and HMRC may decide to review how itis working in order to coincide with the new disclosure facility.

It should be noted that COP9 does not automatically give an upfront immunity from prosecution, as is the case with the LDF.

As an example, if an individual does not accept HMRC’s offer under the terms of the Code of Practice 9 or the CDF, HMRC may start a criminal investigation at any point after refusal of the offer.

In addition, the March budget announced that the “strict liability offence” for holding an overseas bank account is being thrown open again for consultation. If this is not implemented, we will no doubt see a considerable increase in investigations, including criminal ones.

What does all this mean?

It is clear that HMRC wish to continue their attack on the offshore arena, but they believe that, by withdrawing incentives to come forward voluntarily, they will be able to better “serve the public” in dealing with individuals who have not paid the correct tax. We will have to wait to find out whether this strategy works.

In the meantime, we can conclude that, with a little under six months to the end of the LDF, time is running out for individuals with “something to declare” on overseas accounts or structures.

They really do need to register to take advantage of the beneficial terms, which will not be available come 1 January 2016. The final countdown has started to the best disclosure facility that HMRC has ever made – and most likely will ever make – available.