The government’s Making Tax Digital (MTD) initiative has progressed more slowly than originally planned, but it is moving forward, and will continue regardless of Brexit. The first area where MTD has imposed new obligations is VAT.

Except for a small minority, since April 2019, VAT registered businesses with an annual turnover above the VAT threshold (£85,000) have been required by law to use MTD to meet their VAT obligations. This involves setting up a digital tax account and filing quarterly returns online, using an accounting system or app that is integrated with HMRC’s new digital gateway.

MTD’s first six months: positive results

Earlier this year, Volterra Partners’ report The Productivity Payout: UK Small Businesses and the Digital Economy looked ahead to the potential benefits of MTD for VAT and Open Banking for small and medium-sized enterprises (SMEs):

‘This first phase of MTD has the power to catalyse an initial annual productivity payout of £6.9bn. Industry schemes – such as the integration of Open Banking into accounting software – have the potential to act as an additional catalyst.’

‘If SMEs do indeed take up this opportunity to realise all the benefits of accounting software rather than only the features needed for narrow compliance – MTD is set to catalyse an immediate annual benefit of £6.9 billion.’

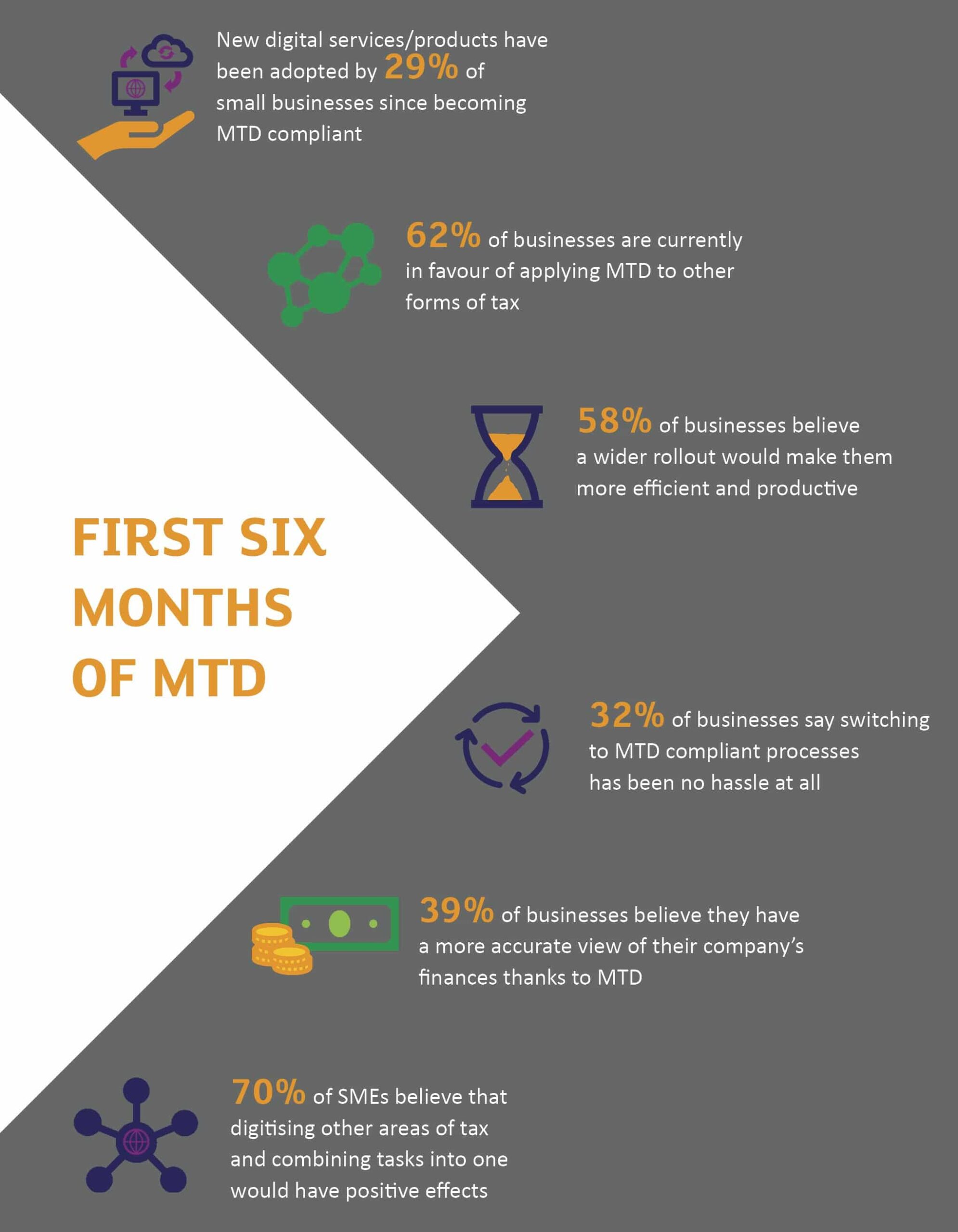

A study released last week by Intuit QuickBooks has shed light on the effects of MTD in its initial six months. It includes several encouraging results:

For the accounting press, the study’s headline-grabbing figure was £815m. As AccountingWEB puts it, MTD so far ‘could have helped the UK’s small businesses realise over £815m in productivity gains’.

In our view, it is too early to make such a statement or verify that figure. In the first six months of MTD, and in the preceding period, companies had to spend extra time on understanding the MTD requirements, selecting a system, migrating to that system and training their employees. While this may have been straightforward for micro-entities, more complex businesses have had to consider wider business processes and invest significant resources.

Productivity gains will also have been affected by IT issues: various HMRC glitches that stopped clients signing up in time; frustrating drop-offs in connections between HMRC and the accounting systems.

HMRC will be mindful that other countries have introduced digital tax initiatives ahead of the UK – including Mexico in 2010, China & Poland in 2016 and Brazil & Spain in 2017 – and that overcoming MTD glitches is not only in UK taxpayers’ interests but will enable HMRC to fulfil its ambition ‘to become one of the most digitally advanced tax administrations in the world.’

Exploring the benefits

Of the BKL clients we’ve signed up to MTD so far, 83% use digital accounting systems. In preparation for MTD, we have helped over half of those clients with their first steps into the world of cloud accounting in the last 12 months.

The majority of our clients who have gone through the process are supportive of the benefits of MTD, including:

- More efficient bookkeeping

- Fewer errors in their data, as they and HMRC share the same data

- A clearer view of their finances and cashflows

- Better management information

- HMRC being able to approve refunds that currently cause extra checks more quickly

- More free time

Most of those clients have also shown a growing curiosity about how the benefits of technology beyond MTD – corroborating the ‘digital snowball’ forecast by Volterra Partners in their report. We’re pleased to support this impetus for change and help clients to explore new opportunities for improving their productivity.

Preparing for the next six months

The six months ahead will include the next phase of the MTD introduction. April 2020 will mark the end of the so-called soft landing period: for VAT periods starting 1 April 2020, there must be a digital link where different softwares are used to produce a VAT return and submit to HMRC.

With over one million VAT registered businesses set to be affected, this will involve even more widespread investment in online accounting software – and you may be wondering what your business should do next.

If you’re not using online software yet, the prospect shouldn’t worry you. It’s an opportunity to become more efficient and more profitable. Both are things we are pleased to support our clients with: we work closely with our recommended provider Xero, as one of their platinum partner firms.

If you would like to discuss your options, please get in touch with your usual BKL contact or use our enquiry form.

To understand more about MTD you can also visit our MTD hub, which includes answers to frequently asked questions.