Although the government’s Making Tax Digital (MTD) initiative has progressed more slowly than originally planned, it is moving forward and will continue regardless of Brexit and coronavirus. This month, two further stages of MTD were announced. They involve VAT and income tax in 2022 and 2023 respectively.

Since April 2019, businesses above the VAT threshold of £85,000 have been required by law to use MTD to meet their VAT obligations: setting up a digital tax account and filing quarterly returns online, using an accounting system or app that is integrated with HMRC’s digital gateway. From April 2022, this will be expanded to all VAT registered businesses with turnover below £85,000.

A further MTD expansion from April 2023 will cover self-employed businesses and landlords who file income tax self-assessment tax returns for business or property income over £10,000 annually.

MTD has been an opportunity for many small and medium-sized enterprises (SMEs) to become more efficient and more profitable, with support from cloud accounting systems such as Xero, our recommended provider.

In our experience, SMEs with a simple business and VAT structure can certainly benefit from Xero. If you would like help to register for MTD and introduce Xero into your business, our outsourcing team would be glad to support you. Please get in touch with your usual BKL contact or use our enquiry form.

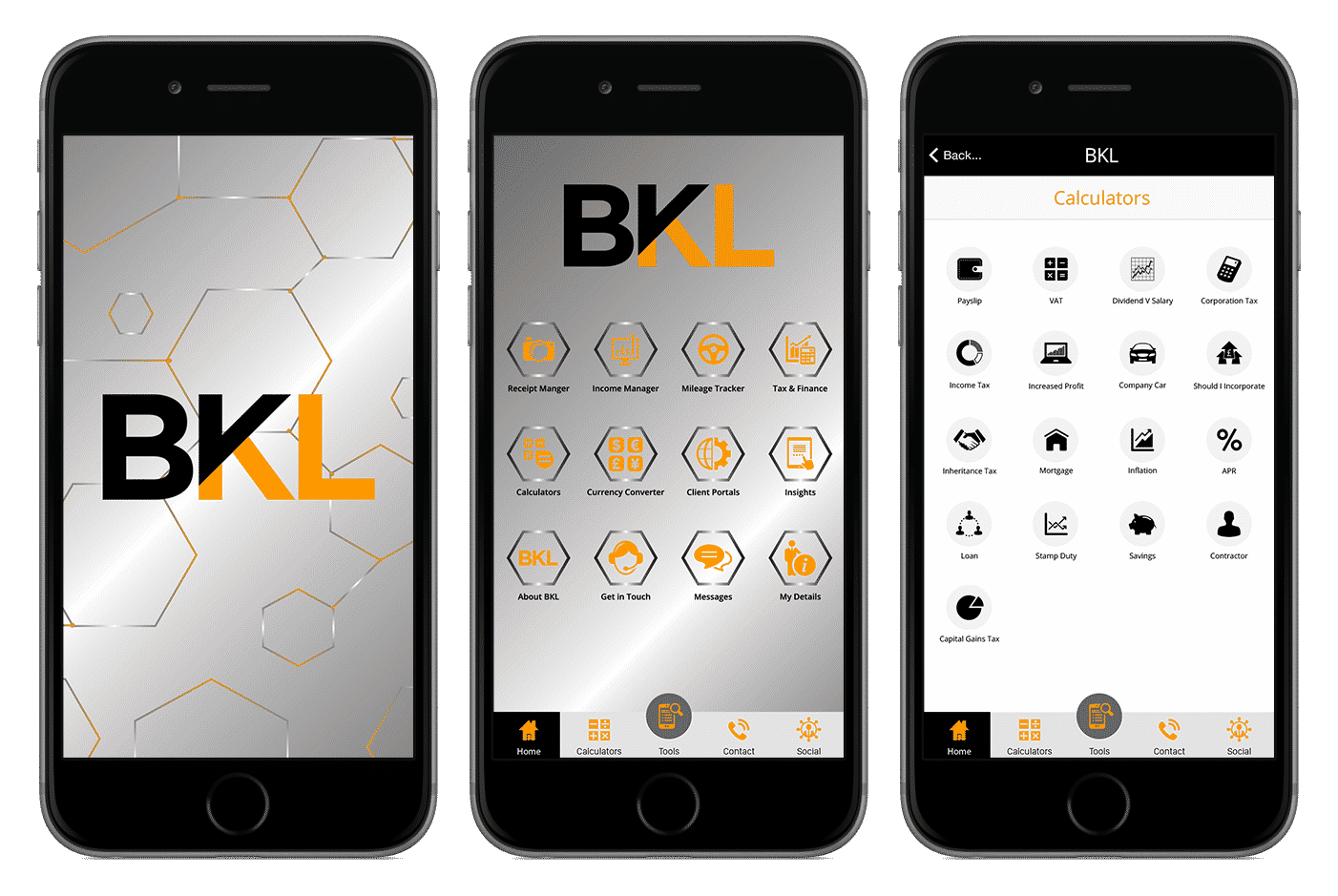

To understand more about MTD you can also visit our MTD hub, which includes answers to frequently asked questions. You can download our app too: it’s updated for MTD and works with Xero and other bookkeeping software.