Since April 2013, HMRC has used the Statutory Residence Test (SRT) to help establish the tax residence status of people with a connection to the UK. Determining an individual’s correct UK tax residence status can help ensure they pay the correct amount of tax in the UK.

If your status is defined as tax residence of the UK, this could mean your worldwide income is subject to UK tax. Failure to declare and pay tax on any income would lead to penalties and fines.

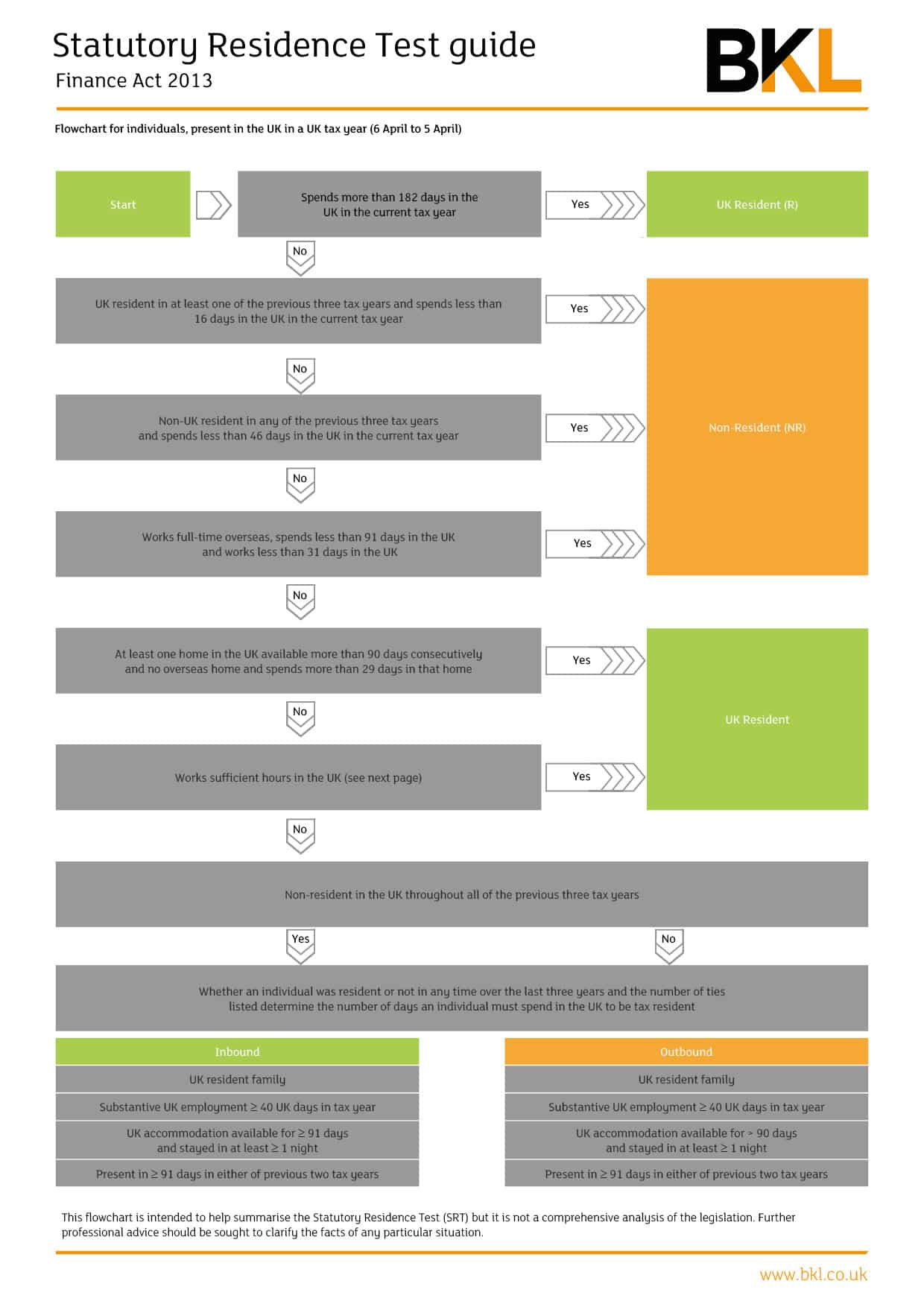

There are four key components to the SRT:

- Days spent in the UK during a tax year

- Working full-time overseas

- Working sufficient hours in the UK

- Sufficient Ties Test

Our SRT guide includes a flowchart which can be used as to clarify an individual’s UK tax residence status. Although it is intended to help summarise the SRT, it is not a comprehensive analysis of the legislation. Further professional advice should be sought to clarify the facts of any particular situation.

For more information on determining UK tax residence status, or help from one of our tax specialists, please contact us using our enquiry form.