The Patent Box is a UK regime which affords companies a 10% corporation tax (CT) rate for the additional profits arising from the exploitation of qualifying patents.

This guide will explain the complex rules governing which companies qualify and the calculation of income which falls within the 10% tax rate, enabling you to check your company’s eligibility.

Key features

- Profits from qualifying patents and certain other qualifying intellectual property (IP) rights taxed at a lower effective rate of 10%

- Companies will need to make an election for the Patent Box to apply

- A complex legislative process is set out to calculate qualifying profits which benefit from the reduced rate of tax

- The profits qualifying for the 10% rate are restricted to the extent that associated R&D is subcontracted out to related parties

- Smaller companies may opt for simplified calculations to reduce the compliance burden

- Recognising the delay that can occur in obtaining IP rights, up to six years of additional qualifying IP profits may be brought into the calculations in the year in which the right is granted

Does my company qualify?

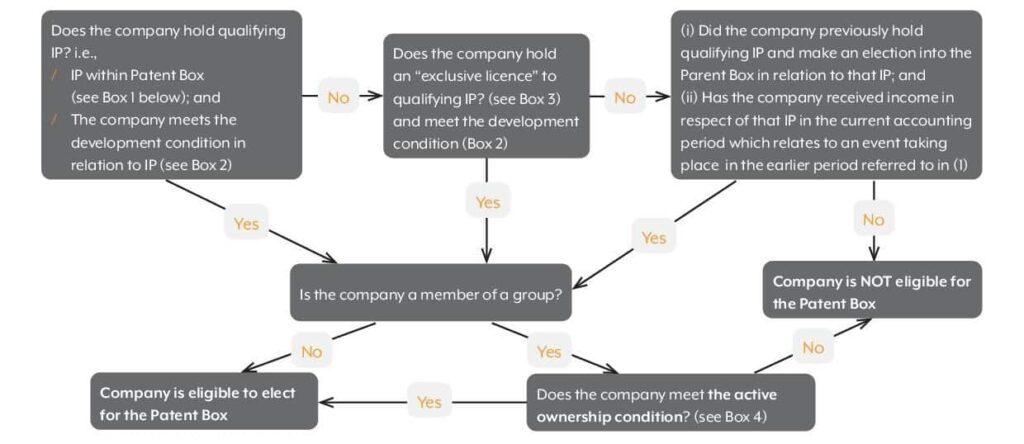

The flowchart and guidance below should be used to establish whether your company falls within the Patent Box regime but broadly the company must own a qualifying patent as a result of in-house development work.

How are Patent Box profits calculated?

The Patent Box affords a 10% rate of CT to the additional profits deemed to arise as a result of holding the patent. There is a detailed, methodical series of steps set out by the legislation to derive these profits and we’ve summarised this below.

As a result of the above, a company qualifying for the Patent Box will effectively pay a blended rate of CT between 10% and 19%, the latter being the main rate of tax for companies (but set to rise from 19% to 25% from 1 April 2023).

Other points

- The legislation contains three anti-avoidance provisions. The Patent Box will not apply where:

- The main purpose (or one of the main purposes) of granting an exclusive licence is to obtain the Patent Box benefit; or

- The main purpose (or one of the main purposes) of incorporating a patented item into a product is to bring income from the sales of that product into the Patent Box; or

- Where the company seeking to make the Patent Box deduction is party to specified types of scheme, one of the main purposes of which is to increase the Patent Box income

- Where a company has Patent Box losses under the above calculations, the amount of the losses reduces the profits calculated for any other trades of the company which are entitled to benefit from a Patent Box election. Where there are excess losses then these are used to reduce the profits of group members which can benefit from the Patent Box. Any remaining losses are carried forward to offset against future Patent Box profits of the company

- Corporate members of partnerships may also benefit from the regime and are specifically permitted to elect to be taxed as if the partnership itself had elected into the regime. A partnership meets the development condition if it had carried out qualifying development itself, or if a “relevant corporate partner” (entitled to at least a 40% share of profits) had done so

- Where a company is party to the exploitation of qualifying IP via cost sharing arrangements, they may also benefit from the Patent Box, notwithstanding that the IP may be legally held by another party

Electing in and out of the Patent Box

If the company meets the above qualifying conditions, it is able to elect into the Patent Box. The election must be made within two years of the end of the relevant accounting period.

Following an election into the Patent Box, it will apply equally to all trades of the company and for all subsequent accounting periods until revoked. Once an election has been revoked, a company will not be able to elect back into the regime for five years. The time limit for revocation is again two years from the end of the chargeable accounting period.

Flowchart to determine if a company is eligible for the Patent Box

Box 1

The key IP rights within the Patent Box are:

- Patents granted under the UK Patents Act 1977, the European Patent Convention or under the law of a specified EEA state

- Supplementary protection certificates concerning medicinal products (and extensions thereto in relation to paediatric indications)

- Rights conferred by marketing authorisations in relation to medicinal products and veterinary products

- Rights conferred by the authorisation of a new indication for a well-established substance

- Market exclusivity rights which arise in relation to orphan medical products (and extensions thereto for products for paediatric use)

- Supplementary protection certificates concerning plant protection product.

- The rights conferred by an authorisation for placing on the market and use of plant protection products

- The right to advertise or sell pesticides

- Rights granted to plant breeders under the Plant Varieties Act 1997 and European legislation

Box 2

A company “A” will meet the “development condition” if any of the following are met:

- A has created or developed the IP and A is either not part of a group, or has stayed in the same group since carrying out the creation/development

- A has created or developed the IP and changed groups, it has continued to carry out development activity for at least 12 months after the change of ownership

- A has been a member of a group since it has held the IP and another group company (“B”) has created or developed the IP

4. B has, at any time, created or developed the IP, B joins A’s group and B continues to carry out development activity for at least 12 months while it is part of A’s group

Box 3

An “exclusive licence” is one which gives the licensee:

- Some unique rights to develop, exploit and defend rights in the IP

- Exclusivity for its rights in at least one country (exclusivity in part of a national territory is not enough)

- The right to bring infringement proceedings to defend its rights or the entitlement to receive damages for infringement

Box 4

The “active ownership condition” is met where company A either:

- Performs a significant amount of management activity (i.e. formulating plans or making decisions in relation to the development /exploitation of the IP) during the accounting period; or

- Meets limb 1 or 2 of the development condition

How are the Patent Box profits calculated?

1. Determine relevant IP income (RIPI)

- Income from sale of patented item (or product incorporating it)

- Licence fees and royalties

- Income from sale of the patent

- Compensation for infringement

- Notional arm’s-length royalties if other group companies exploit the patent

Exclude finance income, and exploitation of non-exclusive patent rights

2. Apportion profits

By default, profits are split pro-rata based on the ratio of RIPI to total gross income

It is possible to make direct allocations of expenses instead on a just and reasonable basis

Exclude finance income and expense in the above

3. Exclude a routine return of 10%

Split the profits apportioned to RIPI into a routine return of 10% on costs and the “Qualifying Residual Profit” (QRP) which is taken as the extra income you have earned because of innovation

The costs on which the 10% return is calculated excludes qualifying R&D but includes normal allowable expenditure and capital allowances

4. Exclude a marketing assets return

This can be done by deducting a notional marketing royalty

Or if QRP is under £1m, by excluding 25% of the QRP as a normal marketing / brand return

5. The nexus fraction

The nexus fraction, also known as the R&D fraction, restricts profits arising from qualifying IP that are eligible to be taxed at the Patent Box rate

The basis of this fraction is the amount of qualifying in-house R&D expenditure that the Patent Box company incurs on that specific patent (or other qualifying IP right), plus third party subcontracted R&D, relative to overall R&D expenditure and any relevant IP acquisition costs

Generally speaking, the more work the company undertakes in-house or subcontracts to an unconnected third party, the more they will benefit from the Patent Box

For each stream of qualifying Patent Box profits, a separate nexus fraction will need to be calculated, based on R&D expenditure incurred on the patent to which the income stream specifically relates

This gives the Patent Box profits, which are subject to an effective rate of corporation tax of 10%. In simple cases, the Patent Box profit may be 75% (RIPI profits – 10% RIPI costs).

Patent Box: how BKL can help

Our tax specialists can assist any company with patents or with the potential to file for patent protection to evaluate the impact of the Patent Box. As part of the company’s tax compliance process, we can incorporate a claim for the Patent Box into the annual corporation tax return.

This can dovetail with any associated claim for R&D tax relief, which we’re also experienced at helping with.

If you would like to discuss how BKL can help, please get in touch.