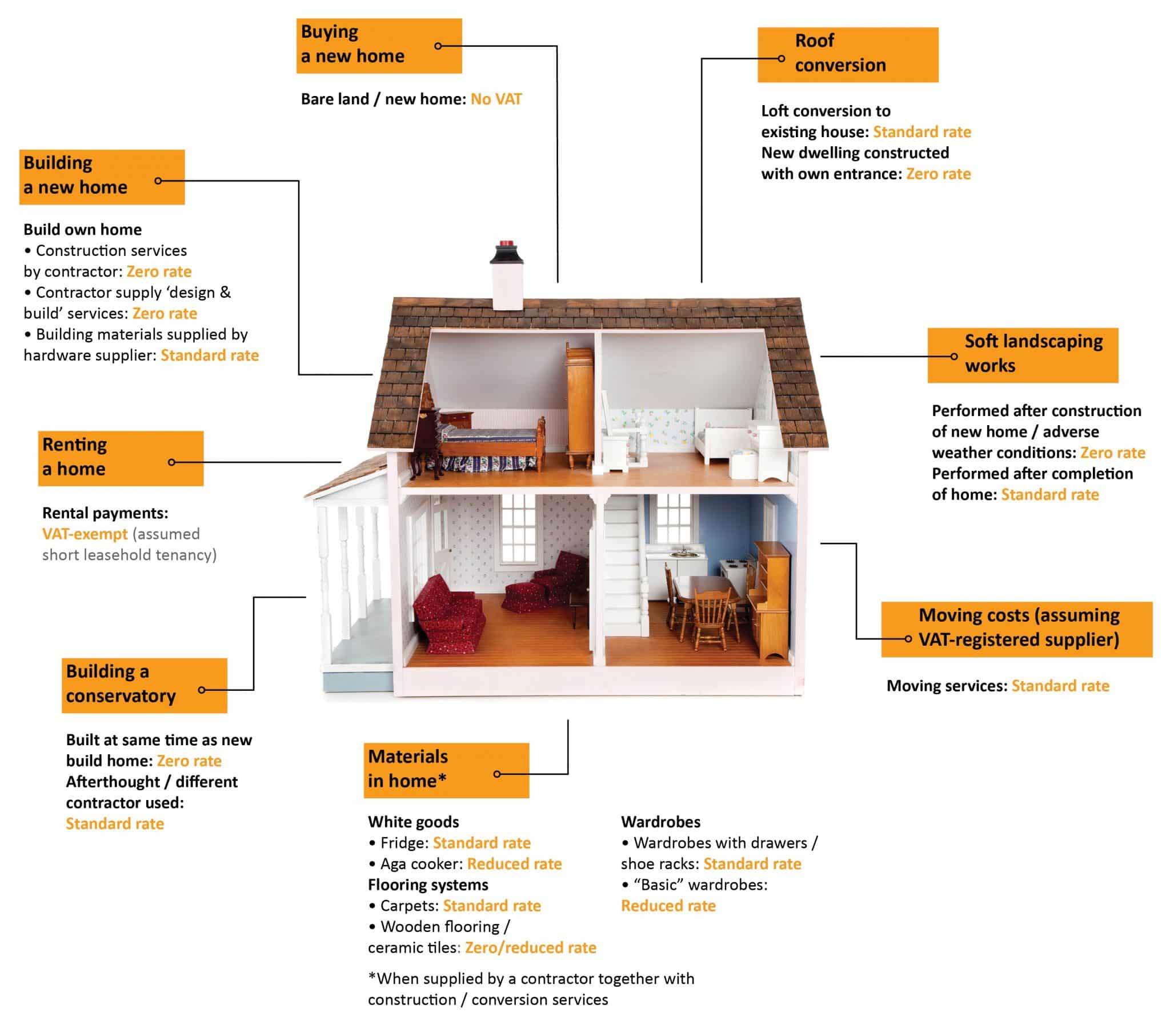

Buying, owning or renting a home gives you a lot to think about, especially if you’re planning building or refurbishment work. One of the property taxes you should consider is VAT: with the right guidance, you can avoid the pitfalls and make significant savings.

Our guide below will show you which aspects have the standard rate of VAT, which aspects are zero rated and which are exempt.

To find out more about how our property specialists can guide you through VAT and other complex property taxes, please get in touch using our enquiry form.