December 21, 2017

Bracing for Brexit: a beginner’s guide

If you’re in the agricultural sector, now is the time to Brexit-proof your farm business...

December 11, 2017

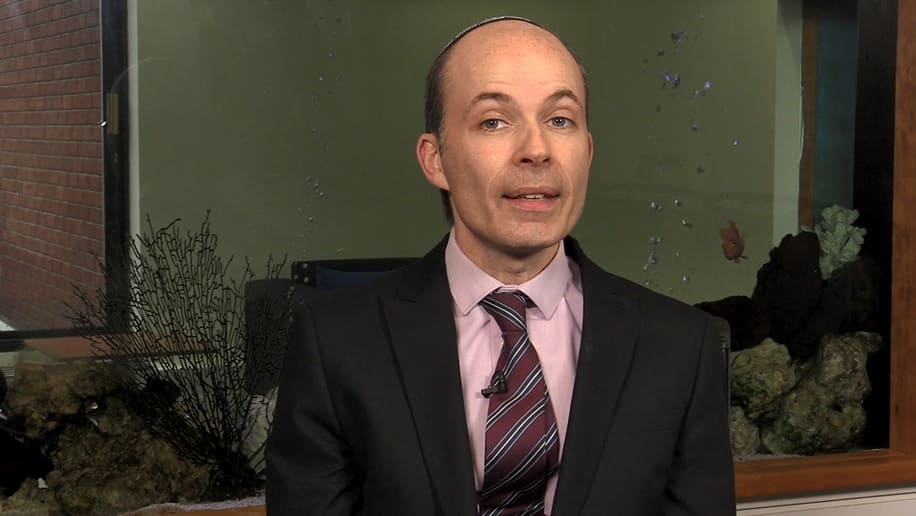

Video: Autumn Budget 2017 Business Tax Update

Anthony Newgrosh, our Head of Business Tax, discusses key tax changes announced in the...

December 11, 2017

Video: Autumn Budget 2017 Property Update

Myfanwy Neville, our Head of Property, explains how the Autumn Budget 2017 announcements will...

November 22, 2017

Autumn Budget 2017: summary

When Chancellor Philip Hammond stepped up to the despatch box, he would have been...

October 26, 2017

Tackling tax evasion: the new corporate offences

To prevent the criminal facilitation of tax evasion, two new corporate criminal offences were...

March 16, 2017

Individual protection 2014: still time to apply

As the deadline draws nearer, we thought it worth reminding that the final date...

March 16, 2017

Spring Budget 2017 update: It’s a NIC out

In our Spring Budget 2017 coverage last week, we reported Chancellor Philip Hammond’s announcement...

March 7, 2017

Never say diesel: bad pollution and budget policy

Concerns about diesel engine pollution are high. Tomorrow’s budget is an opportunity for the...

August 9, 2016

First Direct leads the way in cutting rates

‘First Direct has become the first lender to cut rates on savings accounts following...

May 3, 2016

The high cost of accepting payment: an EMI pitfall

If an employee (including a director) is to enjoy the considerable tax benefits afforded...

March 15, 2016

Javid called to explain bonus

‘Sajid Javid has come under increasing pressure to explain how he benefited from a...

February 22, 2016

Business owners are reluctant to take dividend

‘New data has shown that only 3% of SMEs in Scotland are planning to...