Budget must tackle tax perversity

‘Janan Ganesh calls on George Osborne to use this week’s Budget to tackle the...

Employment Law Bulletin: July 2015

As the school summer holidays approach, the annual juggle of all juggles looms large...

The end of the HMRC’s most innovative disclosure facility ever!

In September 2009, HMRC introduced a (primarily) offshore tax disclosure facility called the Liechtenstein...

SEIS Double Dip?

The Seed Enterprise Investment Scheme (SEIS) is aimed at providing tax relief for equity...

Amazon Lending

BKL tax partner David Whiscombe comments via the UK200Group on news that online retailer Amazon...

Property and real estate

Potential value of older workers to UK economy

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to new research suggesting that...

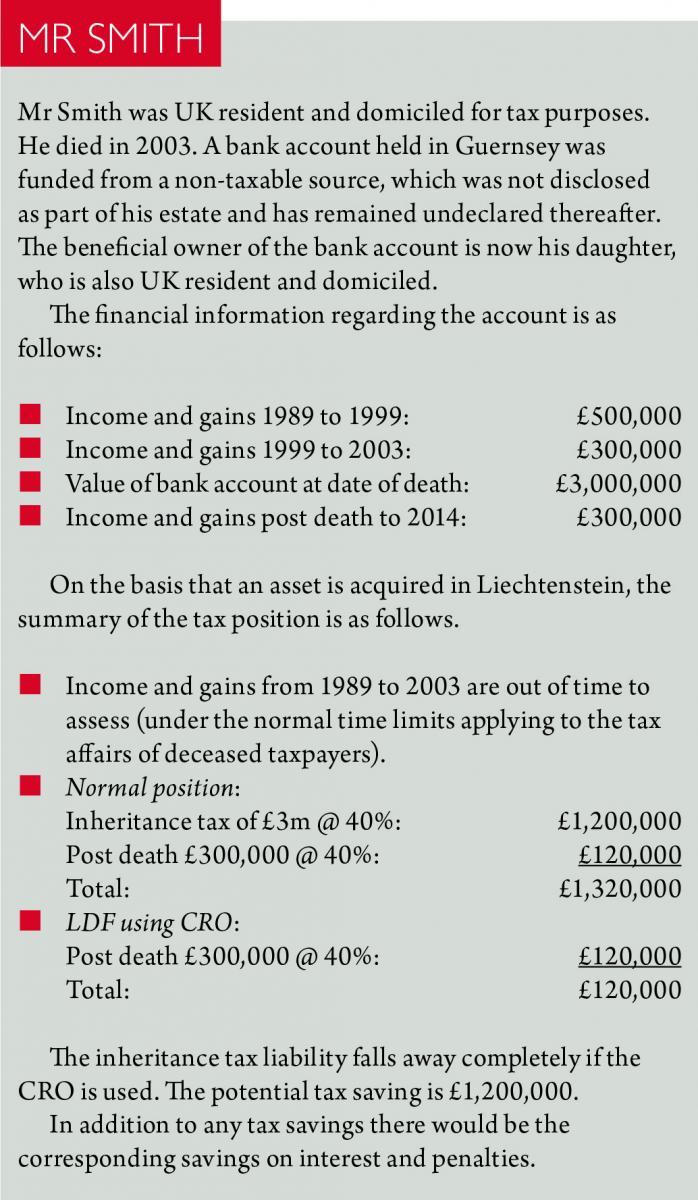

LDF: Final countdown

In an article for Taxation magazine, we examine the impact of the Liechtenstein Disclosure...

Pre-Budget action desirable?

There will be a second budget on 8 July in which it is to...

Cooling off: debt as consideration for CGT disposal

The recent First-tier Tribunal decision in Cooling [2015] UKFTT 223 (TC) is more complex...

Cashing in personal pensions

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to Chancellor George Osborne’s comments...

Incorporation of buy-to-let business

Writing for Tax Journal (issue 1266), BKL tax adviser Andrew Levene answers a query...