December 14, 2022

Accountancy Age interviews: ESG and B Corp certification

After BKL achieved B Corp certification in 2022, Myfanwy Neville, our Head of ESG...

December 12, 2022

Taxation Readers’ Forum: Giving away estate assets

Writing for Taxation magazine’s Readers’ Forum, BKL tax consultant Terry Jordan responds to a...

November 28, 2022

Taxation Readers’ Forum: Share valuation and IHT

Writing for Taxation magazine’s Readers’ Forum, BKL tax consultant Terry Jordan responds to a...

November 28, 2022

Talking Tax with Geraint Jones: introducing inheritance tax

Geraint Jones, our Head of Private Client Tax, sat down with Anthony Newgrosh, our...

November 25, 2022

Nudging landlords: Tenancy Deposit Scheme and letters from HMRC

The law in England and Wales requires that any deposit paid by a tenant...

November 24, 2022

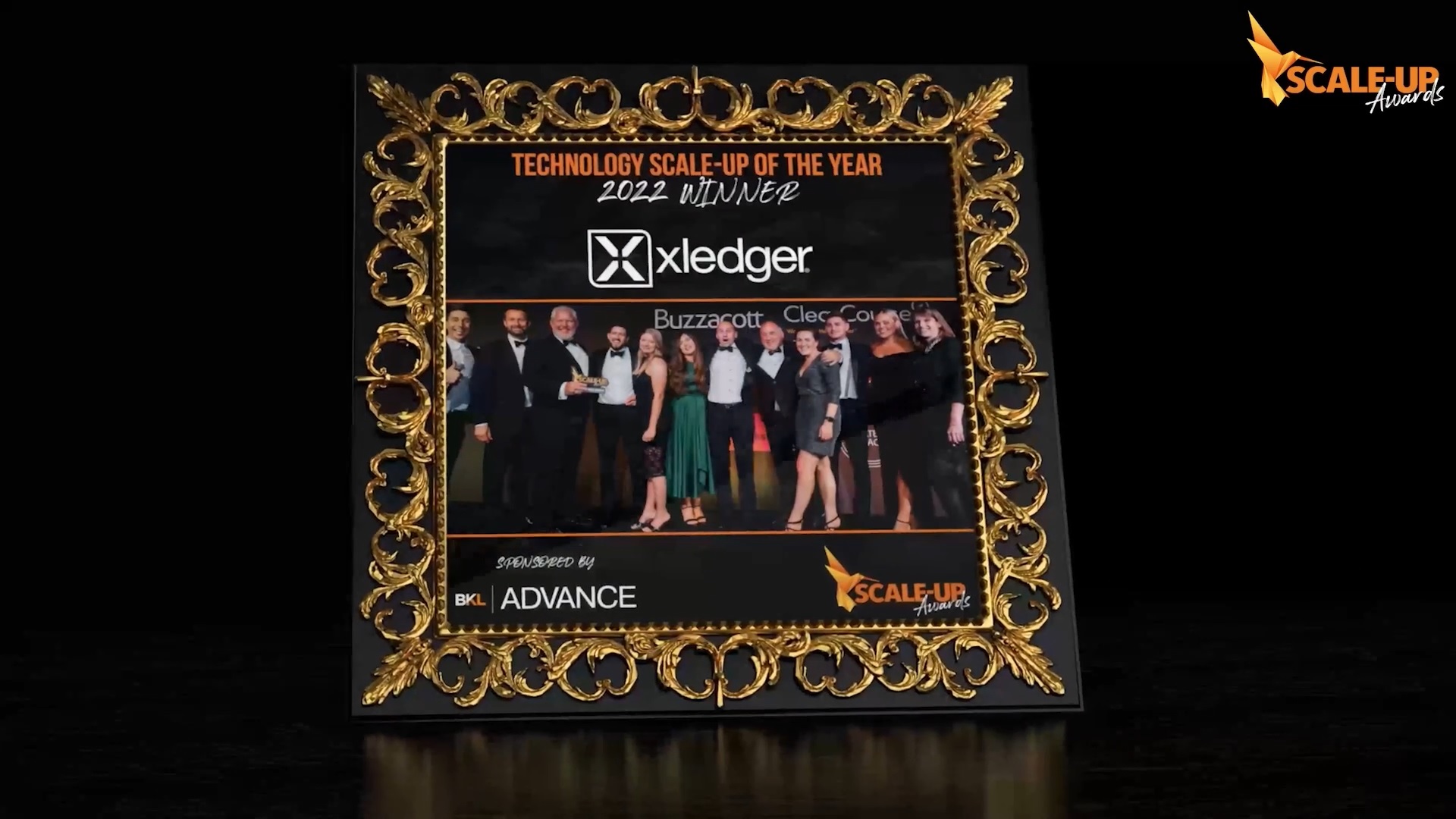

Scale-Up Awards 2022: on the night

After helping to judge entries for the Scale-Up Awards 2022 over the summer, we...

November 23, 2022

BKL at JTrade 2022

Specialists from our property & construction and tax teams were at the JTrade expo...

November 18, 2022

Video: achieving B Corp status

Following BKL’s B Corp certification earlier this year, we were pleased to discuss our...

November 18, 2022

Video: what Autumn Statement 2022 means for you

How will the tax measures announced in this week’s Autumn Statement affect people and...

November 17, 2022

Autumn Statement 2022: key tax announcements

In today’s Autumn Statement, Chancellor Jeremy Hunt sought to restore ‘sustainable public finances [by...

November 15, 2022

McCabe: an insight into residence

The first question at issue in McCabe v HMRC [2022] UKFTT 356 (TC) was...

November 8, 2022

SDLT and couples

Updated: 16 December 2022 If you already own a house (or other dwelling), the...