March 31, 2023

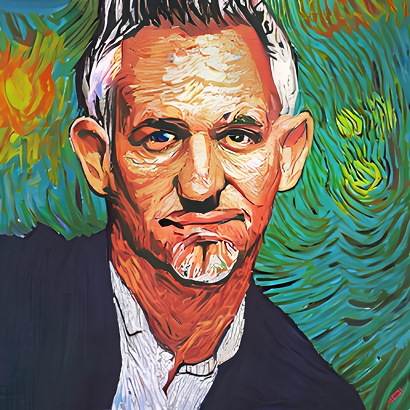

Lineker and the BBC

No: of course we’re not weighing in on that tiff: this note is about...

March 29, 2023

Full expensing: old relief in new clothes

The recent Budget (i.e. Spring Budget 2023) introduced what was described as ‘full expensing’...

March 16, 2023

Spring Budget 2023: the impact on SMEs

Writing for Tax Journal, BKL consultant David Whiscombe examines the impact of Spring Budget...

March 16, 2023

Video: what Spring Budget 2023 means for you

How will the tax measures announced in this week’s Autumn Statement affect people and...

March 16, 2023

Hunt for growth and growth for Hunt: Spring Budget 2023 tax analysis

This is our focus on tax measures announced in Spring Budget 2023: both the...

March 15, 2023

Spring Budget 2023: key tax announcements

In today’s Spring Budget, Chancellor Jeremy Hunt ‘aimed at achieving long-term, sustainable economic growth’...

March 9, 2023

Partnership tax disputes: referral to the FTT

Can it really be right that the taxability (or not) of a receipt can...

March 6, 2023

Mr Hunt’s Cabinet of Curiosities: Spring Budget 2024 tax analysis

Odd, isn’t it, that an impending general election always imbues any Chancellor, of whatever...

March 6, 2023

Discover: Winter/Spring 2023

To tell you about a packed few months in the life of BKL, we’re...

March 3, 2023

Land of Song Tax: additional dwelling surcharges

And here is the third in our trilogy of pieces on Stamp Duty Land...