With the amended FRS 102 accounting standard effective from 1 January 2026, many companies will see a noticeable shift in EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation).

What is EBITDA?

EBITDA is often a key metric for boards, lenders and investors because it focuses on operational performance before the effects of capital structure, tax and non-cash charges. This makes it a commonly used benchmark for covenants, valuations and management reporting.

While this article focusses on EBITDA, other key metrics such as leverage ratios, interest cover and return measures will also change due to the impact on earnings and balance sheet positions.

It is important to note that underlying trading performance and cashflows will remain unchanged. The FRS 102 amendments aim to modernise UK GAAP and improve comparability with IFRS, meaning some costs will move below EBITDA while revenue timing will change for certain contracts.

Here are the two areas that matter most.

Lease accounting: the main driver of EBITDA increase

Currently, rent is an operating expense which is included in EBITDA.

From 2026, rent disappears from operating costs to be replaced by depreciation and interest – which are both non-EBITDA expenses.

Companies with substantial lease portfolios – including retail, hospitality, logistics, manufacturing, healthcare, and gyms – will see potentially substantial EBITDA increases.

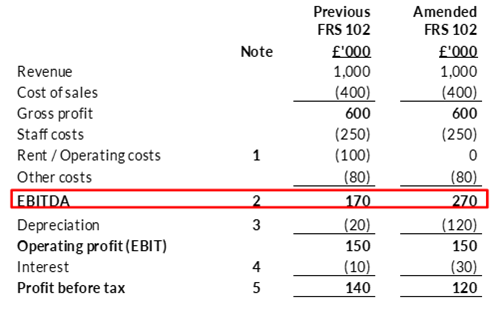

Example

A company paying £100k in rent could see most of that move below EBITDA, creating a mechanical uplift that does not reflect better trading. While it does not change reported profitability over the period of the lease, overall profitability will be lower earlier in the lease and higher later in the lease as a result of the interest unwinding pattern.

Notes

- Rent cost replaced with depreciation and interest

- Increased by amount of rental expense

- Higher due to depreciation on ROU asset

- Higher due to interest on lease liability

- Over time the same but different due to timing

Revenue recognition: EBITDA may increase or decrease

The move to the five-step model (also known as the transfer of control model and listed here) can shift both revenue and profit between periods:

- Some contracts may recognise revenue earlier, increasing EBITDA

- Others may defer revenue until later, decreasing EBITDA

- Margin timing becomes more sensitive to contract structure

The impact will be very specific to each business and its contractual arrangements with customers. Those with long-term projects, software as a service (SaaS) and subscription models, staged manufacturing and bespoke service contracts will be generally most impacted.

A useful precedent: IFRS 16

When IFRS 16 accounting standard introduced lease capitalisation (for IFRS preparers), the market quickly recognised that the resulting EBITDA inflation was an accounting effect, rather than because of stronger trading. There will likely be a period where lenders and investors adjust EBITDA for comparability and gradually the amended FRS 102 format will become the new normal.

Communicating the impact and getting ahead

As always, well-timed and transparent communication is essential to maintaining credibility and avoiding confusion.

Management teams should:

- Brief boards early on the expected EBITDA movement

- Explain to lenders that movements are accounting-driven

- Revisit KPIs, bonus schemes and bank covenants

- Rebase budgets and forecasts using the new rules

- Provide clear reconciliations of old vs new EBITDA

Most companies will see EBITDA increase under the amended FRS 102 due to the impact on balance sheet lease model. The changing revenue recognition model may push it up or down. Early modelling in both cases and clear communication will ensure a smooth transition.

How we can help

We’re experienced at guiding business owners and their teams through implementing new accounting standards. We can help you to understand the impact on your systems, processes and plans, turning technical language into clear explanations.

For a chat about how we can help your business to prepare for the FRS 102 changes, send us an enquiry or get in touch with your usual BKL contact.

Read more about our accounting advisory service.