Readers’ Forum: Single-premium trust

An insurance policy was settled into trust in 1998. The type of trust will...

Should businesses pay any corporation tax at all?

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to a report in the...

Amazon Lending

BKL tax partner David Whiscombe comments via the UK200Group on news that online retailer Amazon...

Potential value of older workers to UK economy

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to new research suggesting that...

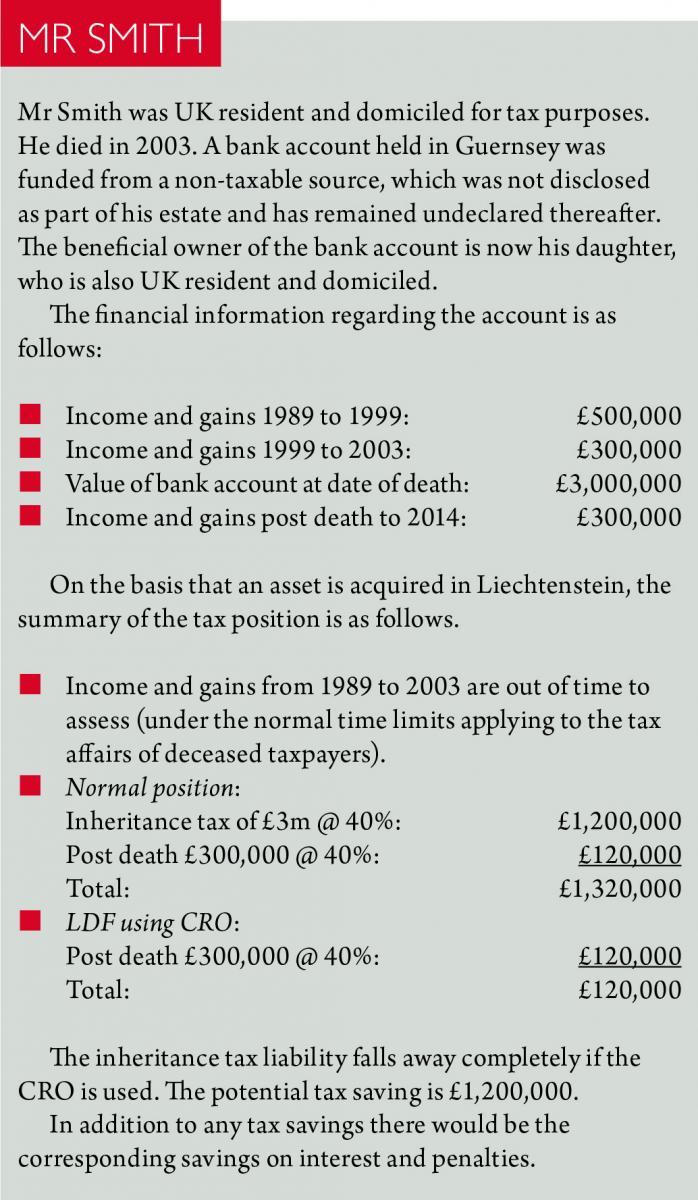

LDF: Final countdown

In an article for Taxation magazine, we examine the impact of the Liechtenstein Disclosure...

BKL Principal makes Accountancy Age’s ‘35 under 35 – practice’ list

Accountancy Age recently released its national list of top ’35 under 35’ high achievers,...

Cashing in personal pensions

Commenting for the UK200Group, BKL tax partner David Whiscombe responds to Chancellor George Osborne’s comments...

Osborne’s plans for permanent surplus

BKL tax partner David Whiscombe comments via the UK200Group on reports that Chancellor George Osborne...

Duty-bound by tax planning pitfalls

BKL tax partner David Whiscombe’s article for FT Adviser on tax avoidance and tax...

Parking a Liability

Will an airport parking space be eligible for business property relief? BKL tax adviser...

Five-year service: pre-owned assets and the £1m nil rate band for couples with property

BKL tax adviser Terry Jordan has written an article for Taxation magazine on pre-owned...

BKL’s Jon Wedge makes Accountancy Age’s 35 under 35 list

Accountancy Age’s 35 under 35 list for 2015 features BKL partner Jon Wedge: ‘Wedge...