December 3, 2025

What Autumn Budget 2025 means for you: watch our webinar with NOON

What Autumn Budget 2025 means for you: watch our webinar with NOON.

December 2, 2025

Autumn Budget 2025 analysed: watch our webinar with Beauhurst

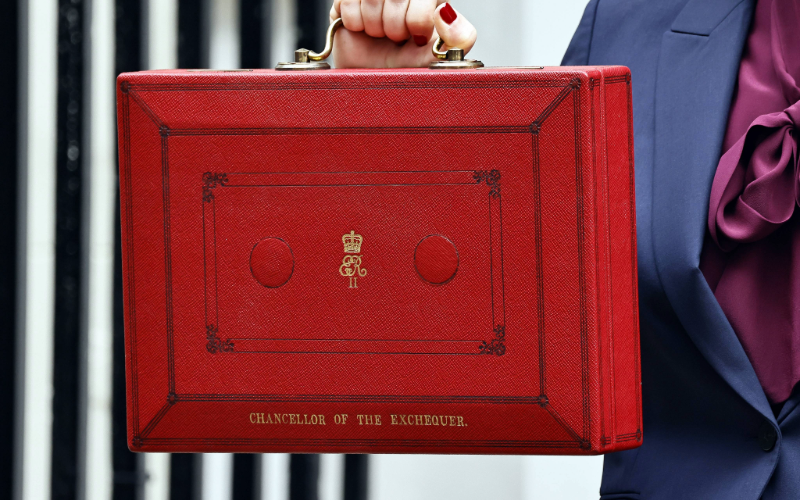

The Chancellor Rachel Reeves delivered the Autumn Budget on Wednesday 26 November. With the...

December 1, 2025

Taxation Readers’ Forum: Inheritance tax, pension withdrawal and gift

Inheritance tax implications of a husband's pension withdrawal and gift to his wife, followed by a gift from his wife to their adult daughter.

December 1, 2025

Enterprise incentives: changes in Autumn Budget 2025 – watch our video

Autumn Budget 2025 included a package of tax changes aimed at supporting investors and...

November 28, 2025

Autumn Budget 2025 and VAT: charities finally allowed to open their Christmas gifts

Imagine tossing away a perfectly good umbrella during a downpour, while someone nearby is...

November 28, 2025

Revised UK VAT grouping rules: could your group be owed a VAT repayment?

If your business is VAT grouped in the UK but has an EU establishment, you could be owed millions in repayments of overpaid VAT.

November 27, 2025

Pensions salary sacrifice: changes from 2029 – watch our video

Major pension reforms around salary sacrifice, announced in the Autumn Budget 2025, will have...

November 27, 2025

Autumn Budget 2025 explained: watch our webinar

On Wednesday 26 November, Chancellor Rachel Reeves delivered the Autumn Budget. With the economic...

November 26, 2025

Autumn Budget 2025 Analysis

The Autumn Budget 2025 introduces a range of tax increases and policy changes, with...

November 25, 2025

Wine, watches and wishful thinking: UK tax mitigation myths

The facts about tax strategies you may be considering – including leaving the UK, settling trusts, and stockpiling wine and watches.

November 17, 2025

Taxation Readers’ Forum: Inheritance tax and normal expenditure out of income

Writing for Taxation magazine’s Readers’ Forum, BKL private client tax specialist Terry Jordan answers...

November 17, 2025

The impact of FRS 102 lease accounting on valuations

The new lease accounting model under FRS 102 could profoundly impact the way businesses with high leasing costs are valued.