November 22, 2019

Accelerated payment notices and Eclipse: HMRC Locked out

The Court of Appeal have quashed follower notices (“FNs”) and accelerated payment notices (“APNs”)...

November 22, 2019

BlackRock and a hard place: financial services, VAT and the reverse charge

Many businesses in the financial services sector are unable to recover VAT because they...

November 19, 2019

Structures as plant: SSE Generation Ltd

Since the Annual Investment Allowance (“AIA”) limit was increased to £1,000,000 (until 31 December...

November 18, 2019

Chargeable benefit: tax advantages of electric and low emission vehicles

Updated: January 2022 The Government have sought for a number of years to incentivise...

November 13, 2019

The Higgins hotel hassle, Chapter 3: CGT and off-plan purchases

David Whiscombe comments on the limits of Main Residence exemption. Broadly, you get full...

November 12, 2019

A Fortnight in Fintech: Libra, Hong Kong, FCA and OneCoin

Where finance meets technology, interesting things continue to happen. As ever, cryptocurrency is a...

November 12, 2019

Dwelling on capital allowances: claiming on residential property

Hora Tevfik v HMRC was a recent case about capital allowances for Houses in...

November 11, 2019

Why do HMRC require self-assessment returns?

You might have thought that the question of why HMRC require people to file...

November 8, 2019

Beware boutiques bearing gifts: property, stamp duty and treading with care

If you’ve made a property purchase, you may then have been contacted by a...

November 7, 2019

Proposed FCA regulations affecting crypto firms from January 2020

An update from our financial services team in conjunction with The MPAC Group. The...

November 6, 2019

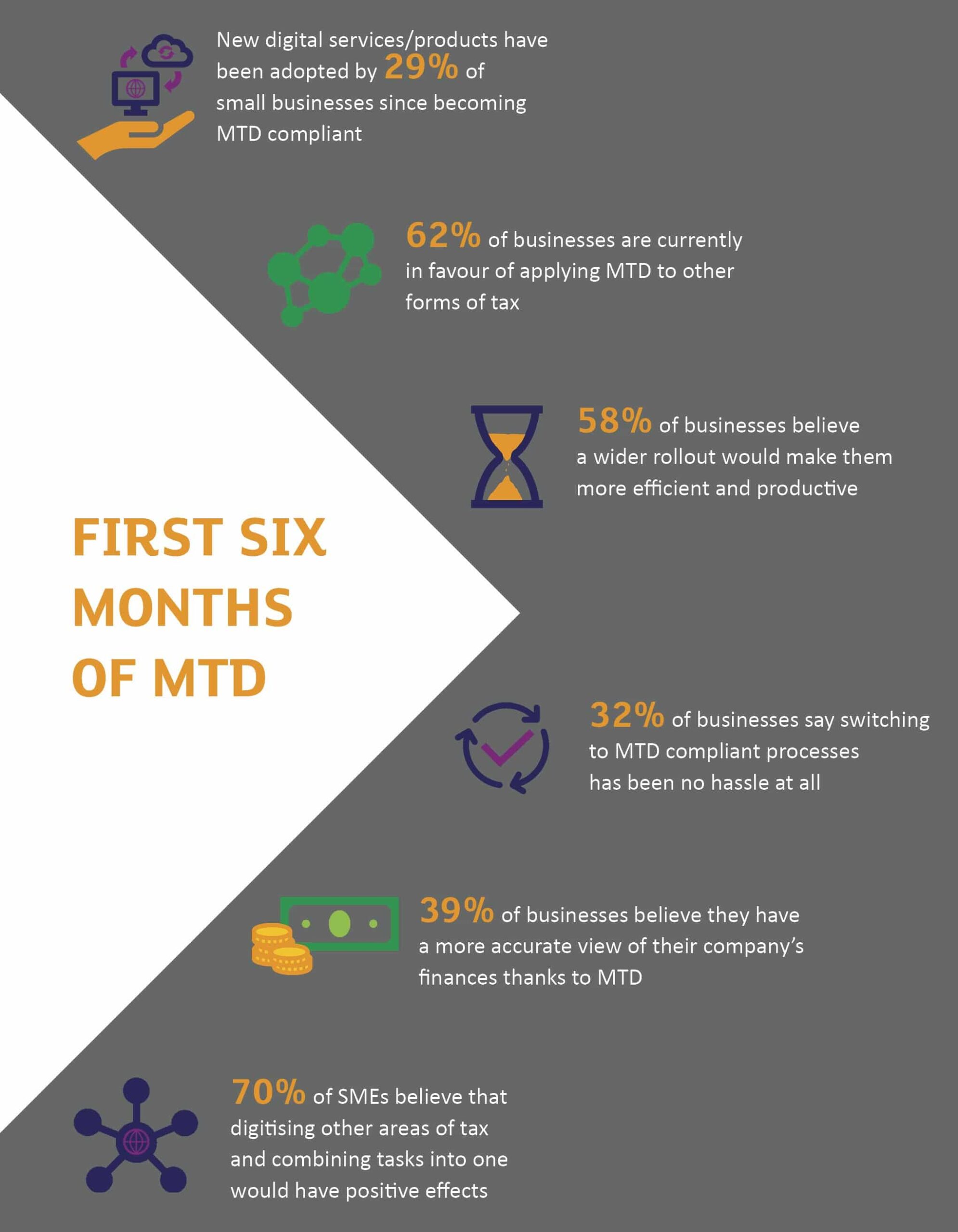

Making Tax Digital: the first six months, the next six months

The government’s Making Tax Digital (MTD) initiative has progressed more slowly than originally planned,...

November 6, 2019

Review of loan charge deferred

In September the Government commissioned Sir Amyas Morse to carry out an independent review...