November 7, 2019

Proposed FCA regulations affecting crypto firms from January 2020

An update from our financial services team in conjunction with The MPAC Group. The...

November 6, 2019

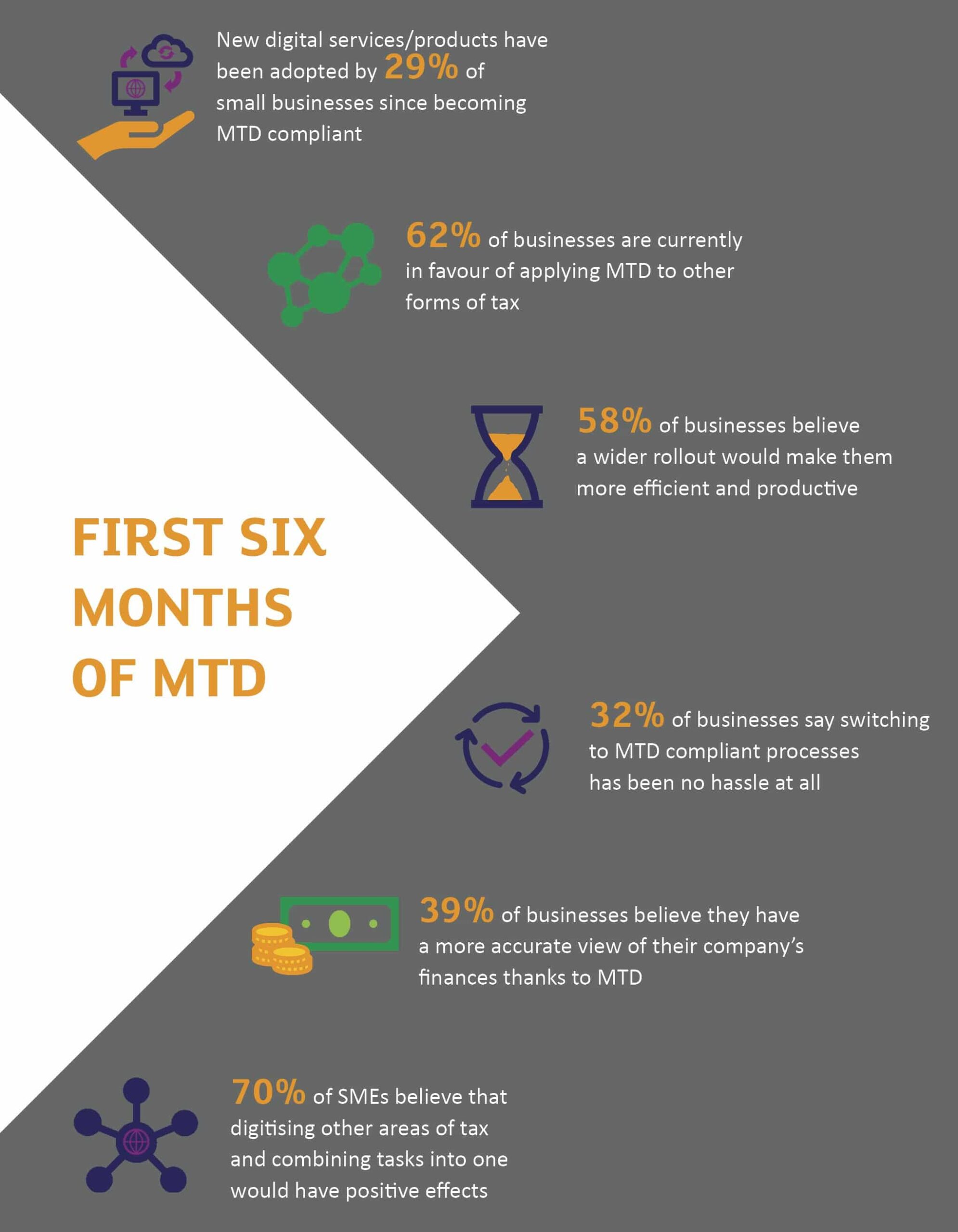

Making Tax Digital: the first six months, the next six months

The government’s Making Tax Digital (MTD) initiative has progressed more slowly than originally planned,...

November 6, 2019

Review of loan charge deferred

In September the Government commissioned Sir Amyas Morse to carry out an independent review...

November 4, 2019

Capital gains tax on property: changes from April 2020

On 6 April 2020, capital gains tax (CGT) on property is changing. This is...

November 1, 2019

Voluntary donations of IHT

When a life insurance policy pays out, the default position is that the value...

October 31, 2019

Is it still worth getting involved with cryptocurrency?

Some of the biggest retailers in the world, including Starbucks and Burger King, now...

October 24, 2019

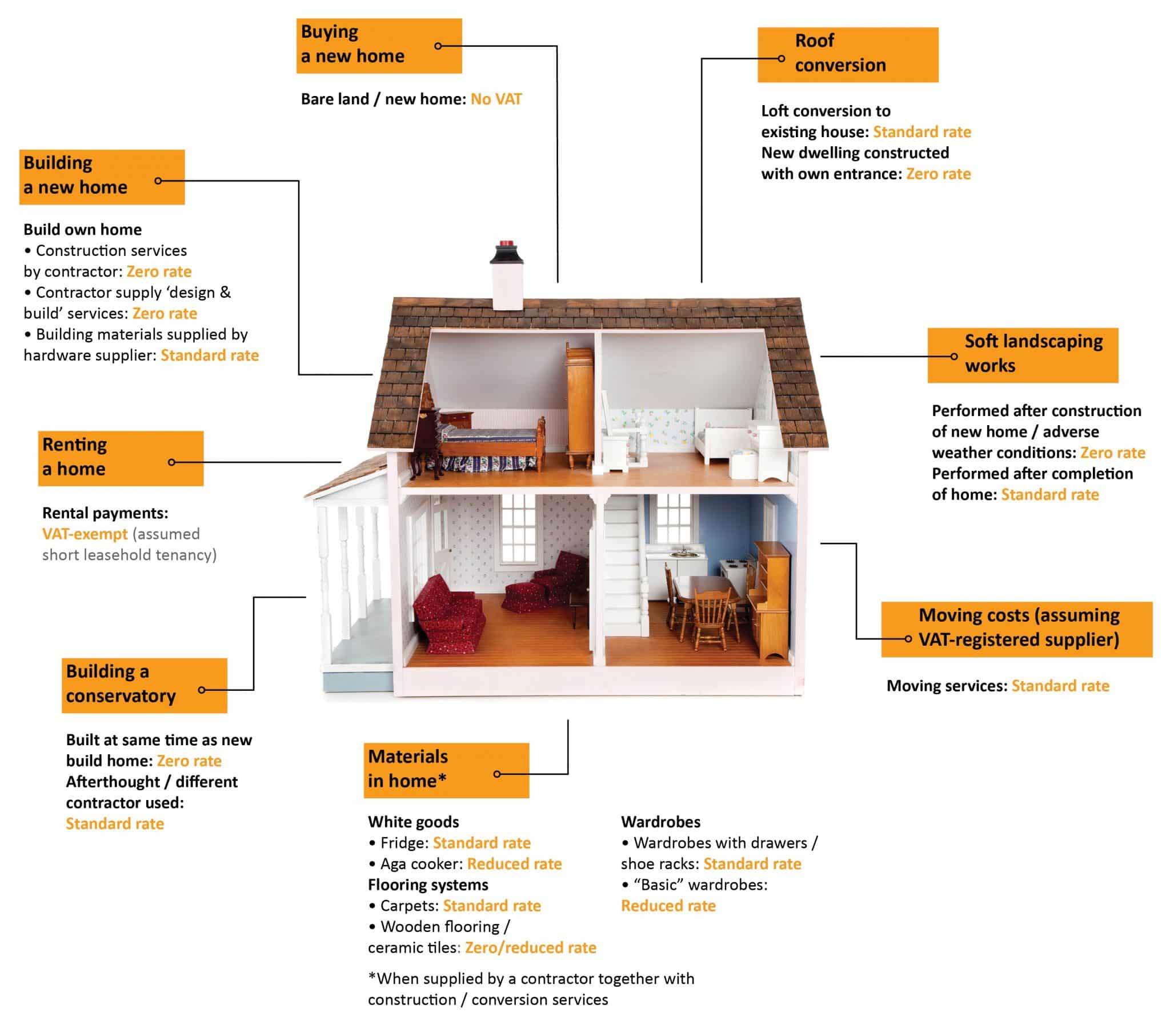

Home VAT home: VAT costs on home ownership and renting

Buying, owning or renting a home gives you a lot to think about, especially...

October 23, 2019

The hanging haystacks of Babylon: is this a business for VAT purposes?

Babylon Farm Limited (“Babylon”) submitted an appeal against HMRC’s decision to disallow VAT recovery....

October 22, 2019

Personally owned business assets: halfway to BPR

One of the most valuable reliefs from Inheritance Tax (“IHT”) is Business Property Relief...

October 18, 2019

Child Benefit pension benefits

Child Benefit has been around since the 1970s. It got complicated when the High...

October 17, 2019

Paying employees in cryptocurrency is risky for workers

Some companies around the world are offering to pay their employees in cryptocurrencies, a...

October 17, 2019

Church construction and VAT: annexe or extension?

Immanuel Church undertook building work and claimed that this qualified as an annexe rather...