July 22, 2019

To give and to hold: capital gains tax holdover relief

Capital Gains Tax (“CGT”) is a tax on, er, capital gains. So how can...

July 20, 2019

Tax on home working and implications for individuals and businesses

In an article for What Investment UK, we explain how working from home has...

July 15, 2019

A Fortnight in Fintech: Bitcoin, blockchain, minibonds and milk

Where finance meets technology, interesting things continue to happen. In recent weeks, our pursuit...

July 10, 2019

Is my compensation taxable? It depends…

A client recently asked us if damages received from an accountant who has given...

July 8, 2019

OTS Inheritance Tax review: our initial reactions

Keen-eyed readers may have spotted that on Friday the Office of Tax Simplification (“OTS”)...

July 5, 2019

A digital assets dictionary

The more time you spend exploring the world of digital assets, the more technical...

July 3, 2019

Too many obstacles to providing affordable homes

Writing for City Matters, BKL property partner Jason Appel urges the UK Government to...

June 27, 2019

A Fortnight in Fintech: FCA, Facebook, Apples and peers

Where finance meets technology, interesting things continue to happen. While the term ‘fintech’ may...

June 19, 2019

VAT and domestic reverse charge in the construction industry: update

Earlier this year, we covered the Construction Services Domestic Reverse Charge (“CSRDC”) and the...

June 19, 2019

Profits, gains and income: which is which and why it matters.

David Whiscombe revisits a question as old as Income Tax itself. “Income Tax, if...

June 18, 2019

Taxes on buying and owning a property

If you’re buying a property, it’s essential to consider tax. Getting it right can...

June 17, 2019

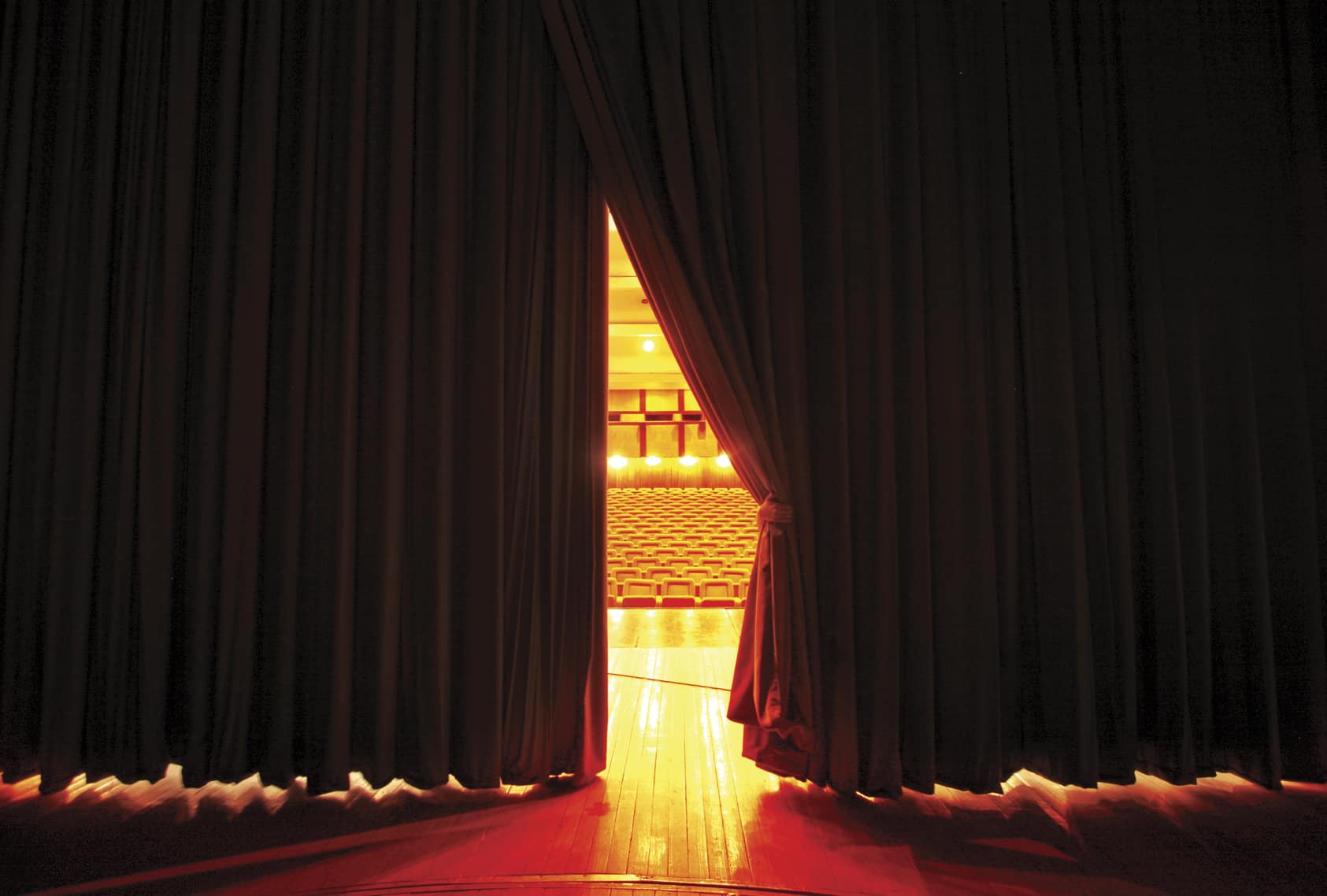

It ain’t over ’til the VAT lady sings: production costs at the Royal Opera House

A decision was recently reached at the First-tier Tribunal (“FTT”) in the case of...