September 27, 2022

BKL’s Sam Inkersole named in Accountancy Age 35 Under 35 for 2022

We’re delighted that BKL tax manager Sam Inkersole has been named in the Accountancy...

September 26, 2022

Video: what the Growth Plan (Mini Budget) means for you

Updated 14 October 2022 The new Government’s Growth Plan (‘Mini Budget’) brought significant tax...

September 26, 2022

Not a Budget: Growth Plan 2022 tax analysis

Updated 17 October 2022 with details of reversals announced during October The Chancellor’s speech...

September 23, 2022

The Growth Plan (Mini Budget) 2022: key tax announcements and U-turns

Updated 17 November 2022 Then-Chancellor Kwasi Kwarteng presented the new Government’s Growth Plan on...

September 21, 2022

CFOs play a critical role in transformation – but owner managers should not lose out

There was a time when the most senior finance officer in a company spent...

September 20, 2022

Is it a dwelling? SDLT consequences

The status of a property as a ‘dwelling’ can be important in establishing liability...

September 15, 2022

Reasonable to avoid s 455, but is it an unreasonable charge?

Writing for Tax Journal, BKL tax consultant David Whiscombe reviews the first GAAR Panel...

September 12, 2022

Proposal to allow IHT-exempt transfers between siblings

Writing for Taxation magazine, BKL tax consultant Terry Jordan explores the proposed Inheritance Tax...

September 7, 2022

Launching a cryptocurrency division

Chris Smith, one of our cryptocurrency tax experts, spoke with Accountancy Today about how...

September 6, 2022

Taxation Readers’ Forum: Tax savings on disposal of UK residential property

Writing for Taxation magazine’s Readers’ Forum, BKL tax consultant Terry Jordan responds to a...

September 6, 2022

Carry-forward of trading losses: generous…

…but not quite that generous. When a trade (or any other kind of business)...

September 6, 2022

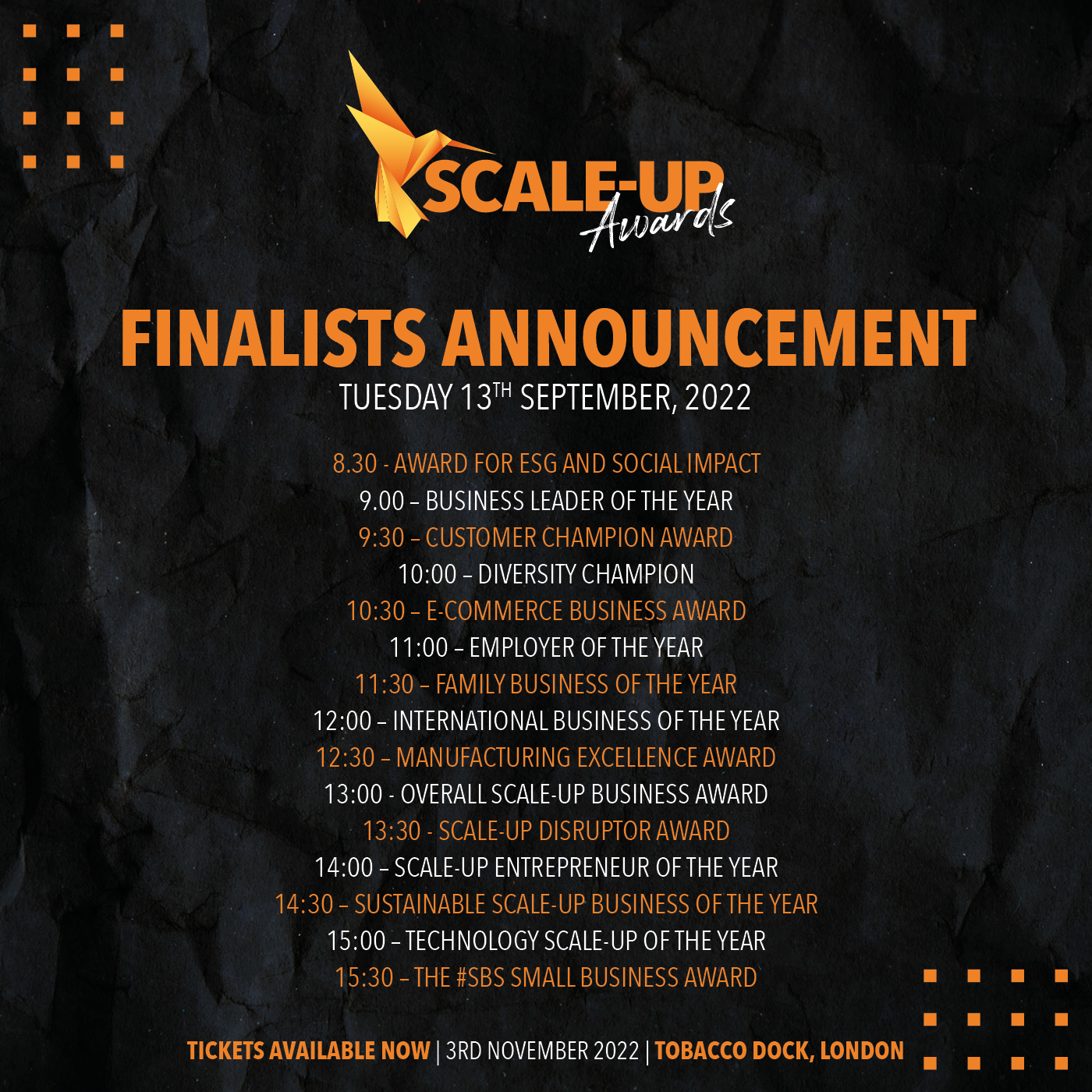

Scale-Up Awards 2022: finalists announced soon!

After helping to judge entries for the Scale-Up Awards 2022 over the summer, we’re...