August 6, 2021

Jason Appel on Humanise The Numbers podcast

Jason Appel, our Head of Accounts, chatted with Paul Shrimpling for the accountancy podcast...

August 3, 2021

It didn’t happen: reversing out of tax schemes

If you’re lucky, the failure of that tax avoidance scheme that seemed like a...

August 3, 2021

Taxation Readers’ Forum: Estate planning and wills

Writing for Taxation magazine’s Readers’ Forum, BKL tax consultant Terry Jordan responds to a...

July 30, 2021

Well at BKL: Summer 2021 update

I’m proud to be involved in inclusion, wellbeing and sustainability at BKL, and of...

July 23, 2021

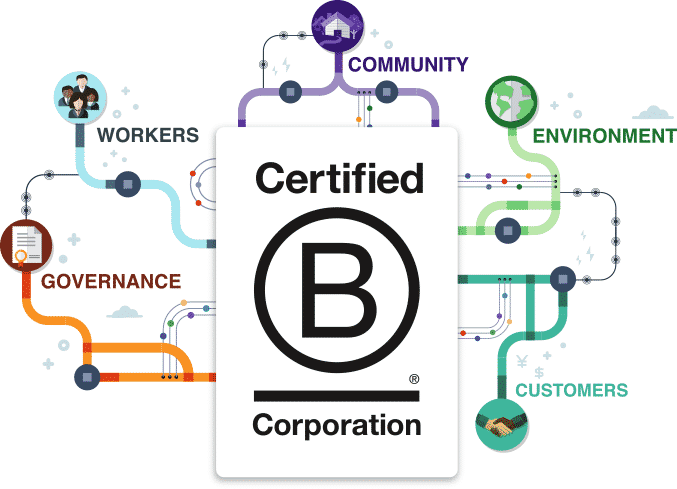

Our Certified B Corporation application

In developing BKL’s approach to good business, we’re excited to have submitted our application...

July 20, 2021

Sales to employee ownership trusts

At certain times of year, a sentence that mentions John Lewis tends to be...

July 12, 2021

A guide to the Patent Box

The Patent Box is a UK regime which affords companies a 10% corporation tax...

July 8, 2021

Donating BKL laptops to Change Please

We were pleased to donate laptops to homelessness charity Change Please this year. Change...

June 30, 2021

Webinar: Commercial property landlords and rent collection data

We were pleased to team up with property management software experts Re-Leased and Wilson...

June 29, 2021

Panel: The future of EMIs

Our recent financial services report offers expert insights into the growth opportunities and challenges...

June 28, 2021

Our Evening With… series

June 25, 2021

Walewski: clarity on mixed partnerships

The Upper Tribunal (‘UT’) have upheld in Walewski v HMRC [2021] UKUT 0133 (TCC)...