October 24, 2019

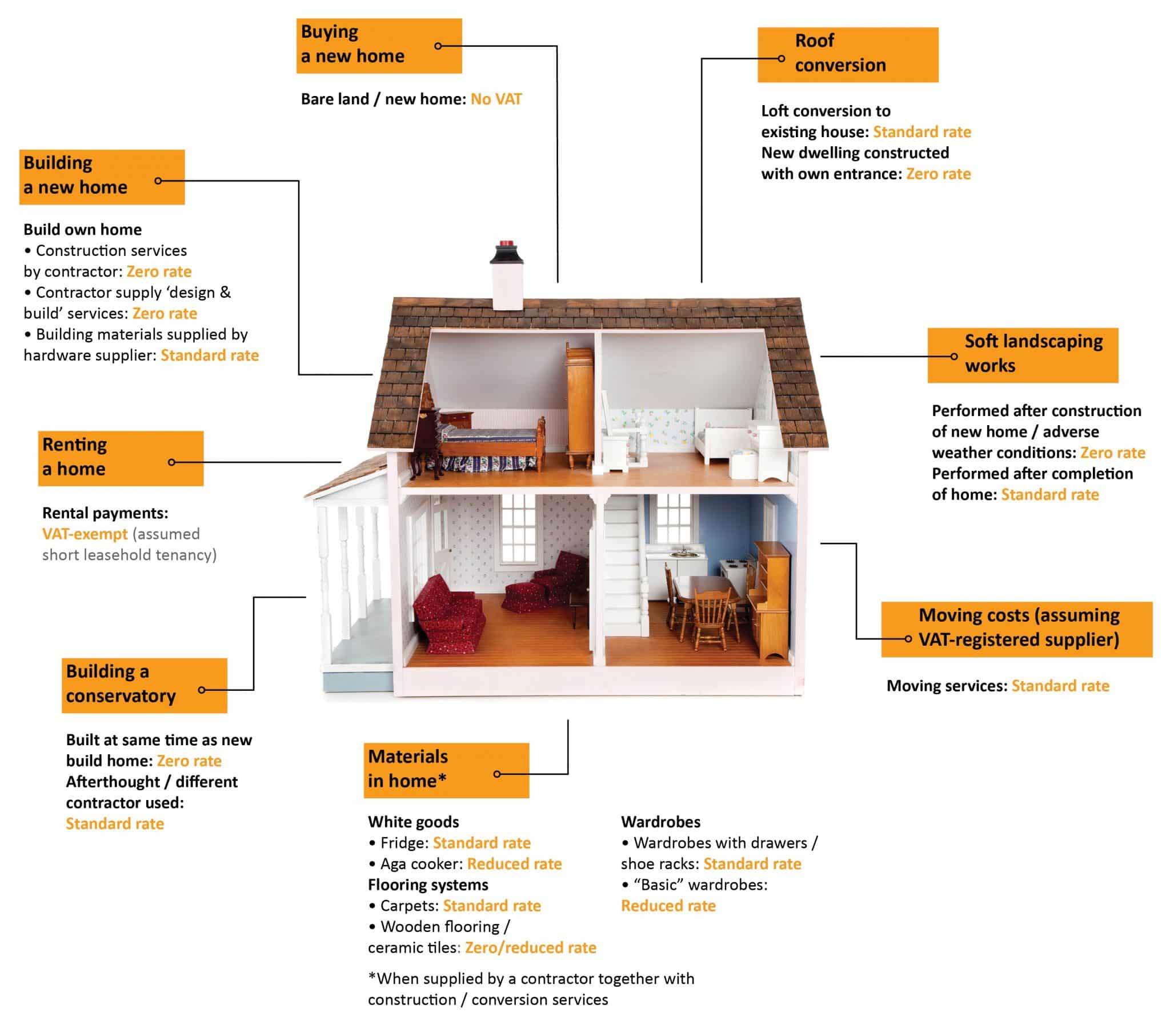

Home VAT home: VAT costs on home ownership and renting

Buying, owning or renting a home gives you a lot to think about, especially...

October 24, 2019

BKL and The Broker Club: Cryptocurrencies and Digital Finance

Our financial services team is pleased to be hosting an event exclusively for brokers,...

October 23, 2019

The hanging haystacks of Babylon: is this a business for VAT purposes?

Babylon Farm Limited (“Babylon”) submitted an appeal against HMRC’s decision to disallow VAT recovery....

October 22, 2019

Personally owned business assets: halfway to BPR

One of the most valuable reliefs from Inheritance Tax (“IHT”) is Business Property Relief...

October 18, 2019

Child Benefit pension benefits

Child Benefit has been around since the 1970s. It got complicated when the High...

October 17, 2019

Paying employees in cryptocurrency is risky for workers

Some companies around the world are offering to pay their employees in cryptocurrencies, a...

October 17, 2019

Church construction and VAT: annexe or extension?

Immanuel Church undertook building work and claimed that this qualified as an annexe rather...

October 14, 2019

Great expectations? Receiving inheritance from abroad

BKL tax adviser and inheritance tax specialist Terry Jordan was quoted in an article about...

October 8, 2019

Open Banking: changes for clients who use cloud accounting

This autumn, Open Banking has been introduced to improve competition in the banking industry...

October 7, 2019

Cryptocurrency buying and selling and how it works

In an article for What Investment magazine, BKL financial services partner Jon Wedge explores...

October 4, 2019

Pension freedoms: staying up to date

Following the admission by the Financial Conduct Authority (FCA) that the introduction of pension...

October 3, 2019

A Fortnight in Fintech: Bitcoin, banks, Libra and LendIt

Where finance meets technology, interesting things continue to happen. We’re pleased to report that...