March 4, 2026

Academy Trust Year-End Guidance: Trustees’ Reports, Audit Preparation and Reserves Management

This three-part academy trust video series provides practical guidance on year-end reporting, audit preparation and financial sustainability.

March 3, 2026

VAT, flexible payment terms and marketing costs: is there a link?

If your business sells goods and offers flexible payment, this Tribunal decision is a must-read.

March 2, 2026

Smart Property Investment in a Changing Market

Insights from our event, covering VAT, market outlook, inheritance tax and structuring decisions.

March 2, 2026

The Moment – February 2026

The Moment - February 2026 Bringing you our latest insights and updates.

February 26, 2026

BKL grow their tax team with new partner and director appointments

Expanding our senior tax expertise with Tommy Roy joining as Private Client Tax Partner, Amanda Varrall as Head of Global Mobility, and three specialist tax directors.

February 26, 2026

Introducing our Newcastle office

If you're based in Newcastle or the North East, you can meet us face to face at our new office in the heart of the city.

February 24, 2026

Companies House filing reforms paused

Planned changes to accounts filing for UK businesses will not be introduced in April 2027 as previously announced.

February 17, 2026

Getting ready for touring: key accounting factors for emerging musicians

Five of the key areas to think about: funding, insurance, payment cards, merchandise and budgeting.

February 10, 2026

Places for People Homes Ltd v HMRC: treatment of residential service charges

A VAT case with major implications for UK landlords, management companies, maintenance trust companies and residential estates.

February 10, 2026

What could the new CASS Assurance Standard mean for EMIs?

When the FRC's CASS assurance standard is revised to bring CASS 15 into scope, how will this impact senior management?

February 5, 2026

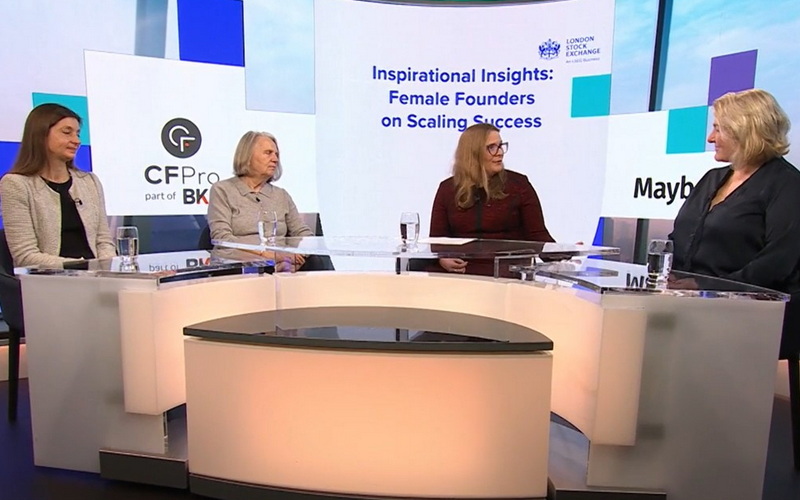

Female founders on scaling

Female founders share insights on starting and scaling a business. Watch two conversations and read Polly Barnfield’s reflections on the realities of growth.

February 4, 2026

TSI Instruments v HMRC: import VAT on after-sales repairs

In confirming a key point about input VAT recovery by the person importing the goods, this Tribunal decision left the company with a £8.5m import VAT cost.